In March, a senior Indian government official told Reuters that the country would propose a law to ban cryptocurrencies. The law would include fines on those holding or trading coins, making it one of the world's strictest policies on crypto assets.

Ultimately, Indian Finance Minister Nirmala Sitharaman disputed the leak, saying that the government's approach would be "very calibrated" and not a blanket ban. The official, however, says that the policy would be "calibrated" regarding the penalties on those who do not liquidate their assets within a six-month grace period. The plan, they said, is to ban private crypto assets but promote the blockchain.

Whatever route the government decides to take, it's clear that it has little love for cryptocurrency. A government panel in 2019 recommended a 10-year sentence for those involved with cryptocurrencies, and top officials have previously named it a "Ponzi scheme".

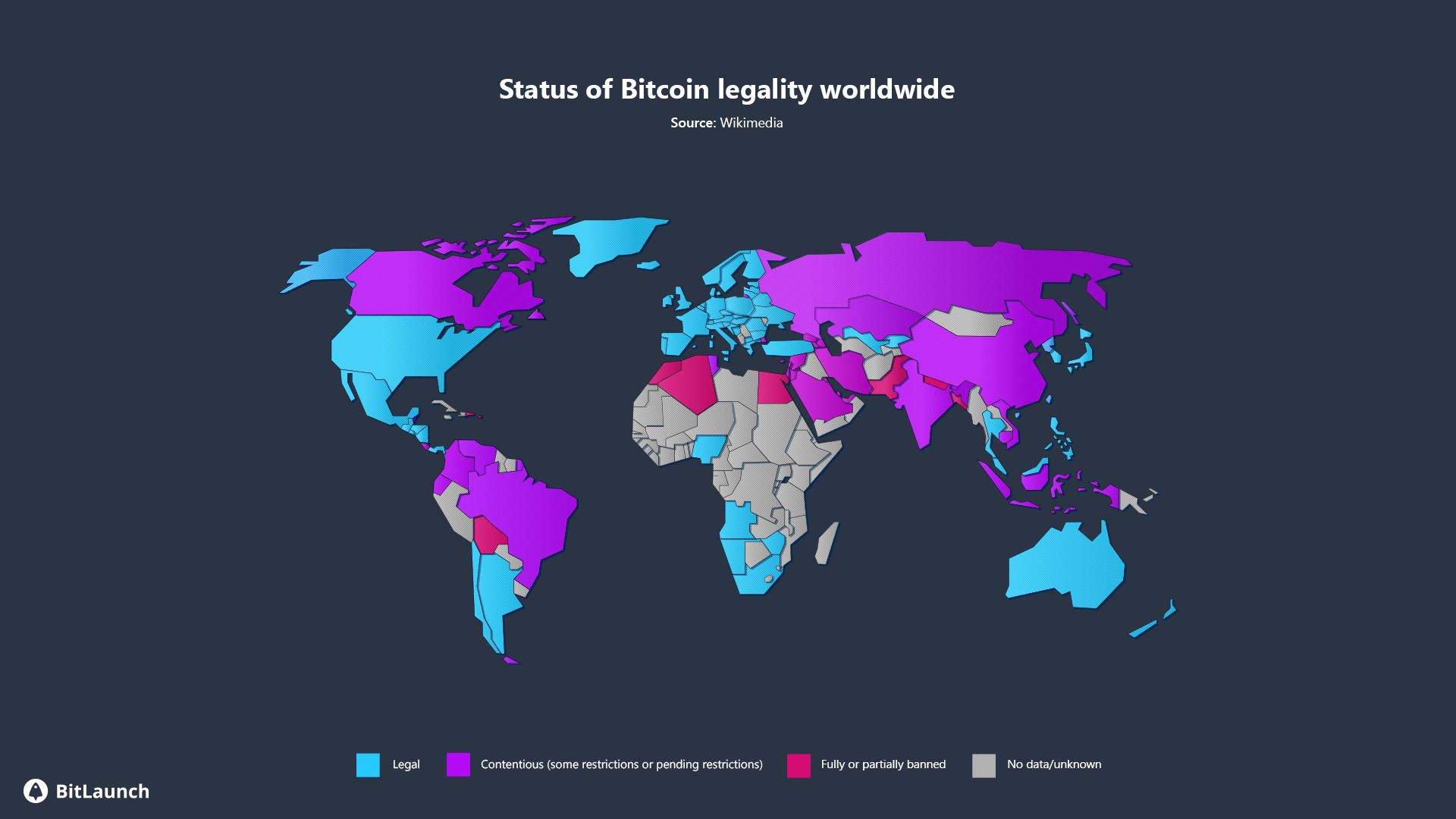

India, of course, isn't the first to mull a crypto ban. Multiple countries have fully or partially banned bitcoin, particularly in Northern Africa, the East, and South America. In many others, the state of cryptocurrency is contentious, with some restrictions, pending restrictions, or restrictions based on the interpretation of old laws.

Why are governments banning cryptocurrency?

Cryptocurrency represents a significant shakeup in the way citizens of the world can store and spend their wealth. However, to characterize government's reluctance as solely fear of the unknown would be disingenuous.

The reason many countries are tough on cryptocurrency is the lack of regulation and central authority. Though this is the very reason many enthusiasts like cryptocurrency, some countries say it poses too big a risk. Turkey, for example, notes that investors can't recover any losses. Whether it's due to safeguarding or a desire for control, the decentralized nature of Bitcoin rubs many governments the wrong way.

Other countries, such as India, point the finger at crypto because they believe it funds illegal activities. This is, of course, true. However, the same can be said for any currency. Indeed, last year the share of cryptocurrency that could be attributed to criminal activity was just 0.34%. To put that into perspective, for fiat currency, the UN estimates that between 2-5% of global GDP is connected with illegal activity and money laundering. The biggest threat in that regard is physical cash, which is still legal in most parts of the world.

Despite the negative associations, most governments acknowledge that crypto is a useful tool. Many, including those who have bans, are working on their own blockchain-based digital currencies. This would allow them to provide the benefits while maintaining transparency and control.

Unfortunately, others still view cryptocurrency as an investment or money-making scheme, ignoring its potential to aid marginalized, unbanked populations.

Cryptocurrency and financial access

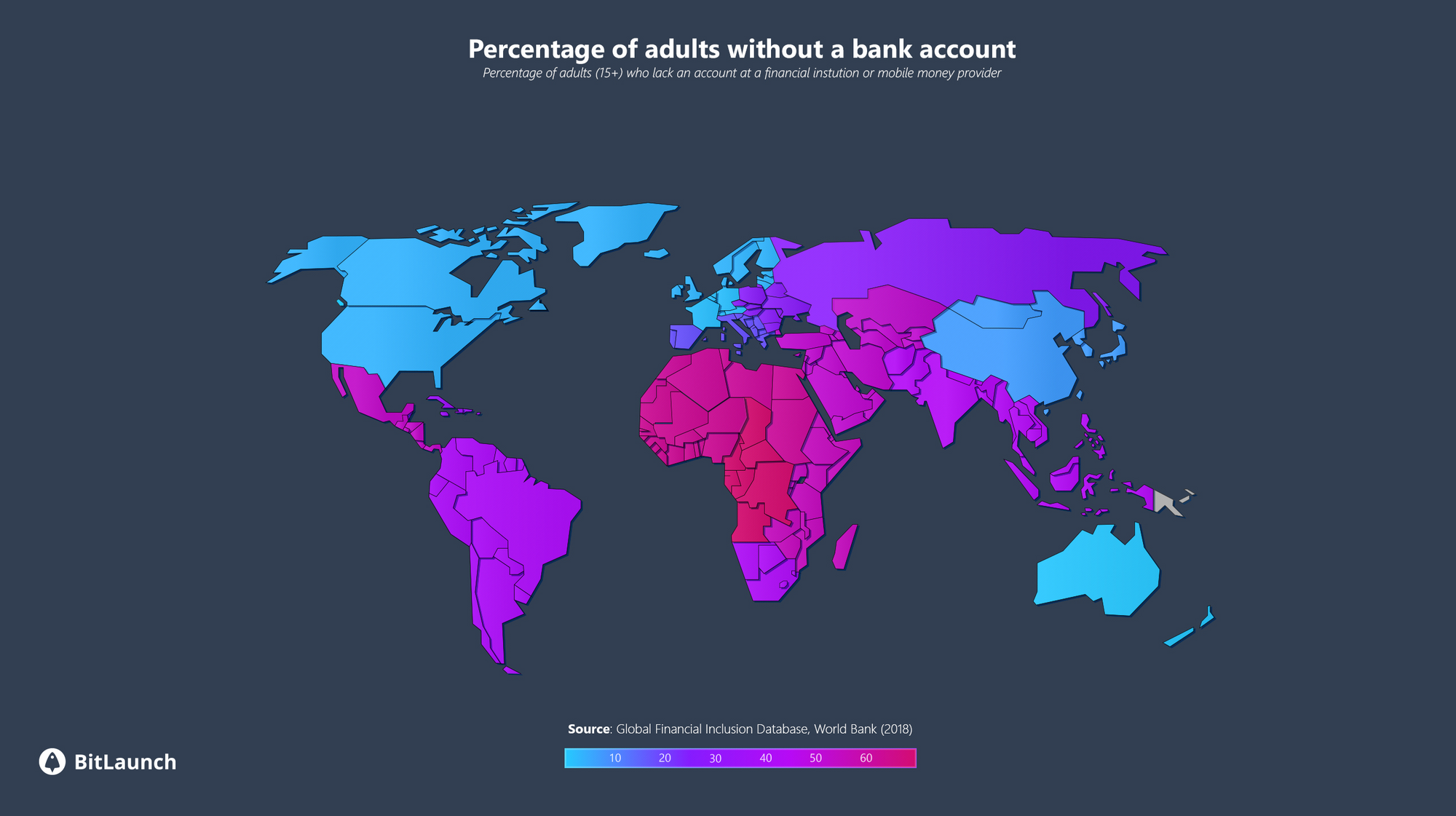

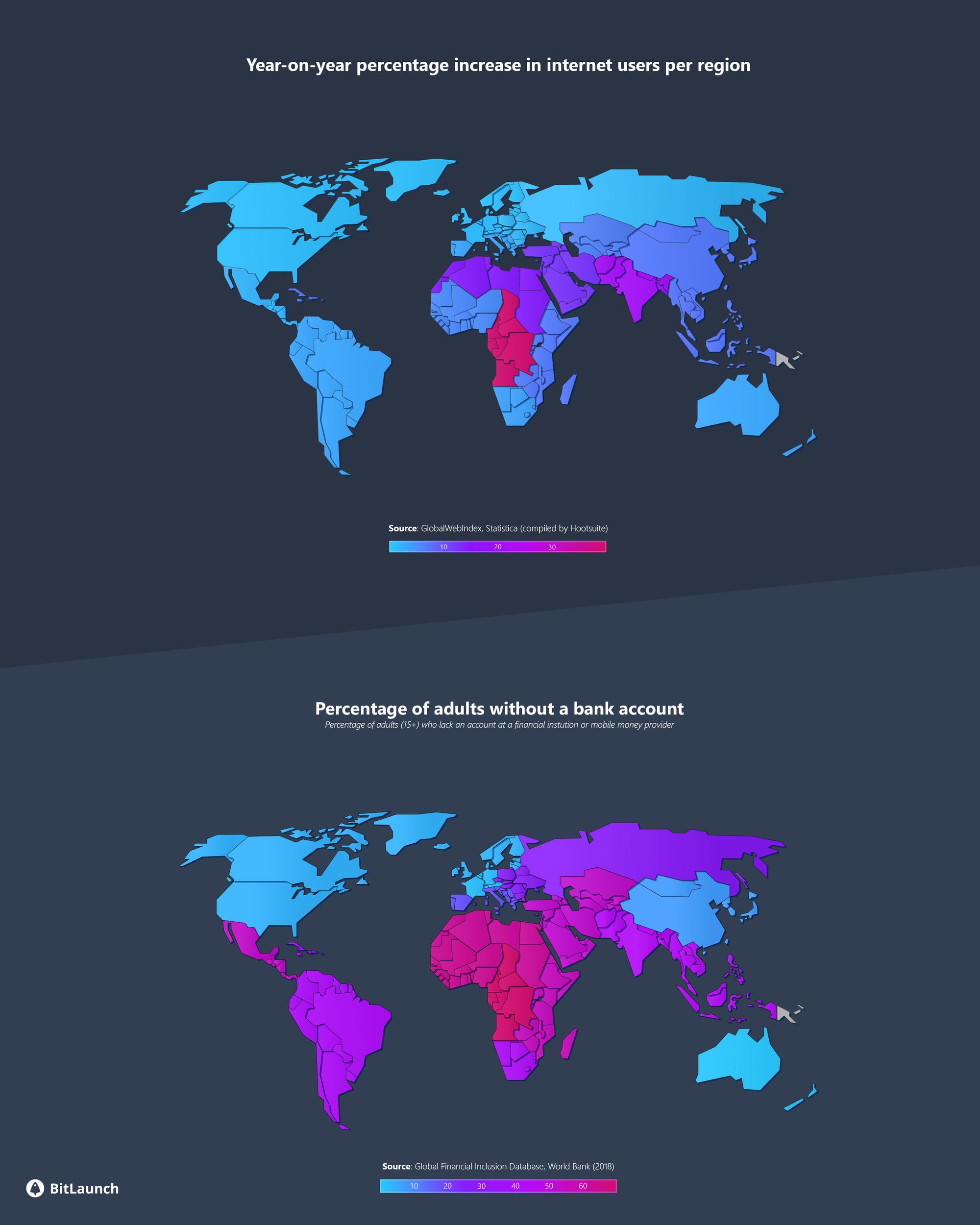

Across the world, internet access is growing rapidly, but the banking infrastructure required for users to fully utilize it is severely lacking.

As a VPS provider dealing exclusively in cryptocurrency, this is an area of concern for BitLaunch. Using publicly available datasets, we have tried to assess the disparity between the growing internet population and bank access.

Though the data presented in the infographic above isn't directly comparable, we think the implication is clear: many regions with rapidly growing internet populations lack widespread bank or mobile money access.

Southern Asia is one area where this is a concern, with a 20% year-on-year percentage change in internet users yet a population that is 48% unbanked. Middle Africa, meanwhile, experienced a 40% growth in internet users in 2020, yet 70% of its population lack a bank account.

Such areas have much to gain from a legal framework that is open to cryptocurrency. Without the need for a bank account or expensive hardware, both private and business users can safely purchase and sell online goods and services of all kinds. Anything from hardware to crafts, web hosting, newspaper subscriptions, VPS servers, and plane tickets can be bought with Bitcoin or Ethereum.

Of course, the methods used to purchase cryptocurrency are still a factor to consider. Most cryptocurrency exchanges require a bank card and identification to trade.

However, Bitcoin ATMs let users trade cash directly for cryptocurrency without heavy restrictions. Citizens aren't hit by requirements such as government identification, good credit, or proof of address, which prevent them from getting a bank account. Availability of Bitcoin ATMs is therefore important, and something we'll be looking into later.

In person-to-person trading, cryptocurrency has proven even more valuable. In Venezuela, which has been battling hyperinflation for years, citizens are turning to Bitcoin. Though Bitcoin has frequently been labelled a volatile currency, it remains far more stable than the bolivar. Peer-to-peer exchanges have gained popularity, while some are even being paid directly in crypto or using it for cross-border payments.

A system that works for all

By allowing users to pay for our services via cryptocurrencies, it's our hope that we can reach those who struggle to access VPS services – whether due to lack of privacy or pure inaccessibility of fiat currency. Utilizing our new payment system, BLPay, it's our goal to allow anyone to spin up an anonymous VPS server in minutes.

We believe that cryptocurrency bans not only threaten this mission but also disadvantage communities across the world who are already struggling. The route to widespread financial access lies not in prioritizing the interests of banks but in embracing new and disruptive technologies. Though it's already too late for some regions, it's our hope that by continuing to educate about and normalize cryptocurrency, we can contribute to a healthier environment surrounding it.

If you'd like to support that goal, please feel free to sign up for BitLaunch today. Our live chat will happily provide you with some free credit to get you started on your journey.